Ability to track performance (Total Return)% by excluding loans (Margin Trading)

closed

C

CT-jO3eogjQ

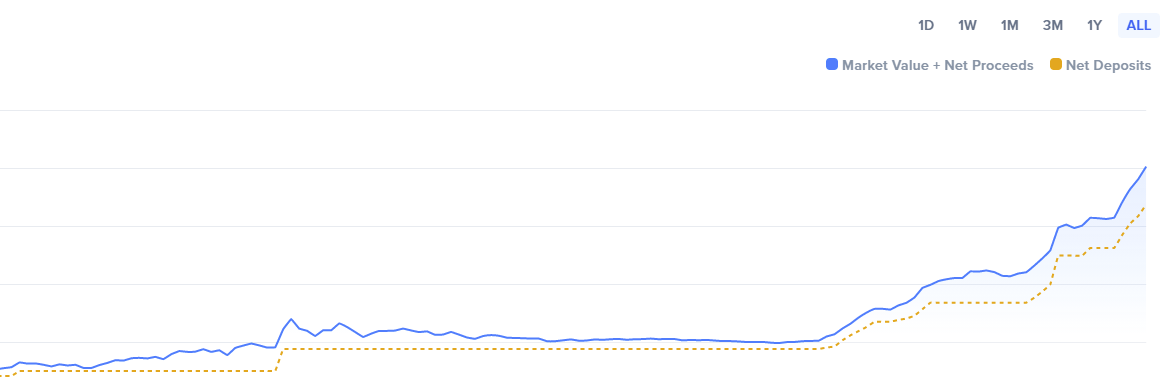

The Problem: I'm the portfolio subscriber and I'm trading with margin, i.e. getting loans at my Binance account. It would be awesome to be able to exclude loans from performance reports. At the moment loans are included under Total Return calculations in percentage. As a trader, I'm interested to see my performance based on my initial capital and this was one of my expectations to baing able to track as a paid portfolio subscriber.

Also, at the moment Deposits are in constant growth as loans are included in it, so the total return% is inaccurate for a person as a margin trader.

However, from a tax perspective, I think there are no issues with this, this is mainly only reporting issues on how to represent returns for margin traders to see actual returns in % calculated accurately.

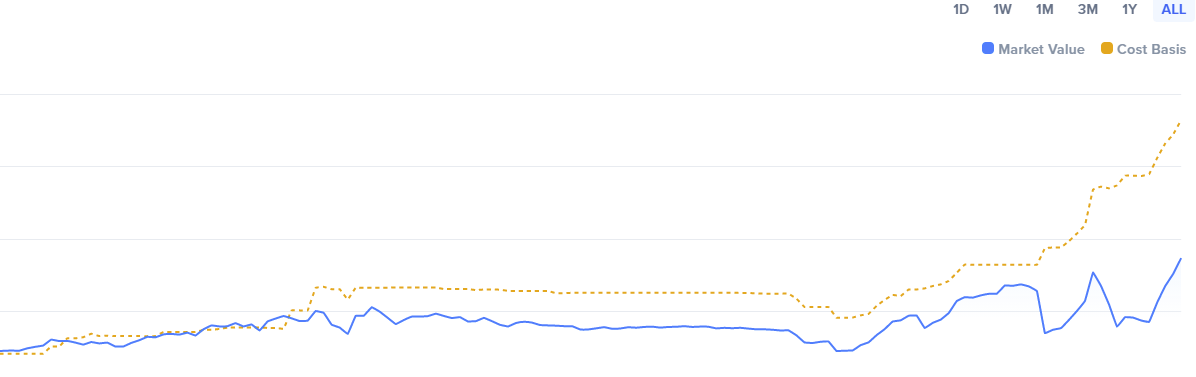

Additional Problem: because of this, if I switch to Unrealised Performance, then the numbers are completely off and they are reporting very incorrect data and showing negative numbers where it should be positive. This is because Cost BAsis is constantly growing with Loans (margin trading). But in the meantime, my withdraws are deducted from the Cost BAsis, but not when I return loans.

Potential Solution:

- It might be a global setting like, exclude loans from Return calculation or something, that the return % is accurate and based on my initial capital.

- Maybe there might be additional data for a portfolio subscriber to see additional data based on initial capital additionally to already reported insights.

- Maybe introduce new metrics which is Account Equity - Dept? Or in CoinTracker terms that would be "Your Portfolio excluding dept". And then return based metrics are calculated based on that?

Log In

Sarah R - CoinTracker

closed

Hello! This post is being closed automatically because it has not received any upvotes or activity in the past year, and we cannot find any related posts.

This auto-closing is not permanent. If you would like to submit the post again then please submit an updated post on our New Posts board. Our support team will review the post and categorize it.

If you would like to connect with our the CoinTracker support team directly, please reach out!

Thank you,

CoinTracker Support