new

improved

fixed

September Update

The IRS just proposed 282-pages of new crypto tax regulations. Our team has sifted through it and summarized it here, outlining how CoinTracker has you covered as the ecosystem evolves. We are also excited to share our latest product updates that make your taxes even easier:

👛

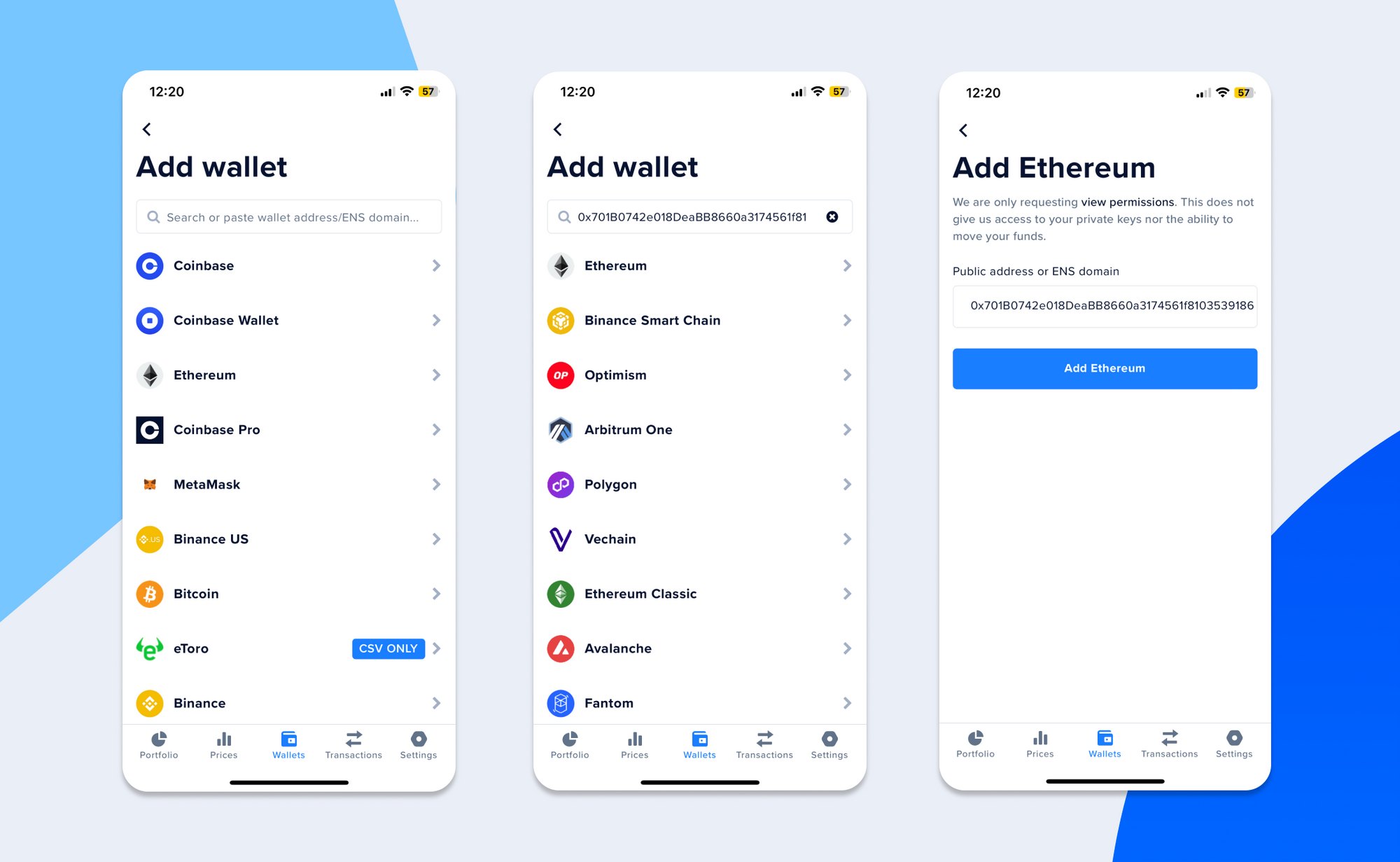

Add wallets seamlessly on mobile

You can now seamlessly add wallets on the CoinTracker mobile apps. We’ve launched a sleeker experience, built specifically for mobile, so you can easily add your wallets on the go. Try adding your exchanges and wallets to CoinTracker today (Android, iOS).

👋

Goodbye spam tokens

No more pesky spam tokens inflating your portfolios. We recently launched an update that fixes spam tokens masquerading as legitimate ones. This fix has automatically been applied to your account, and you’ll see more accurate portfolio balances and transactions. Head over to your dashboard to see it live.

💌

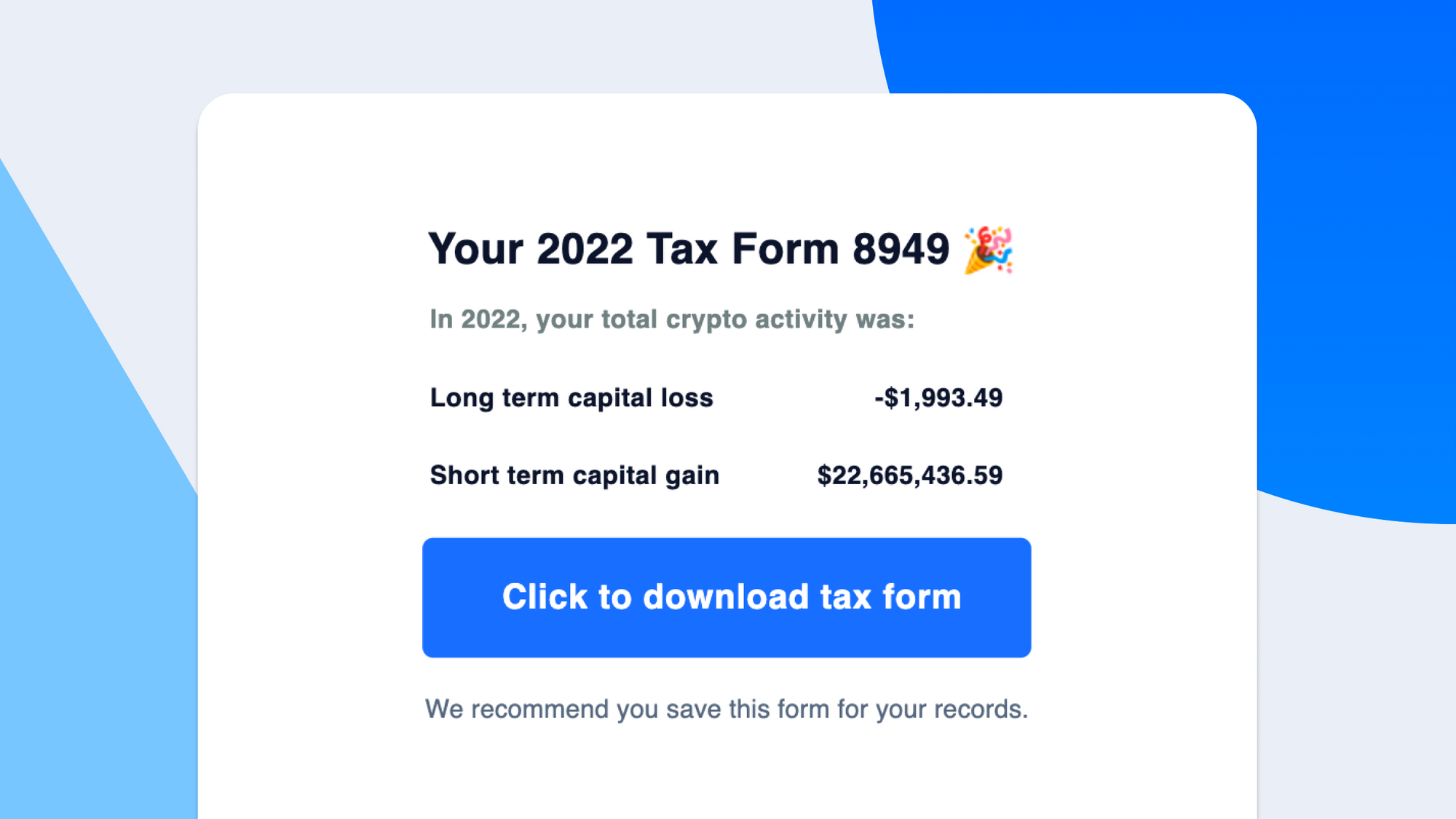

Downloadable tax form links

To protect your privacy, CoinTracker now sends you download links for tax forms rather than email attachments. Pro tip: Save these forms so you can easily refer to them later.

🔢

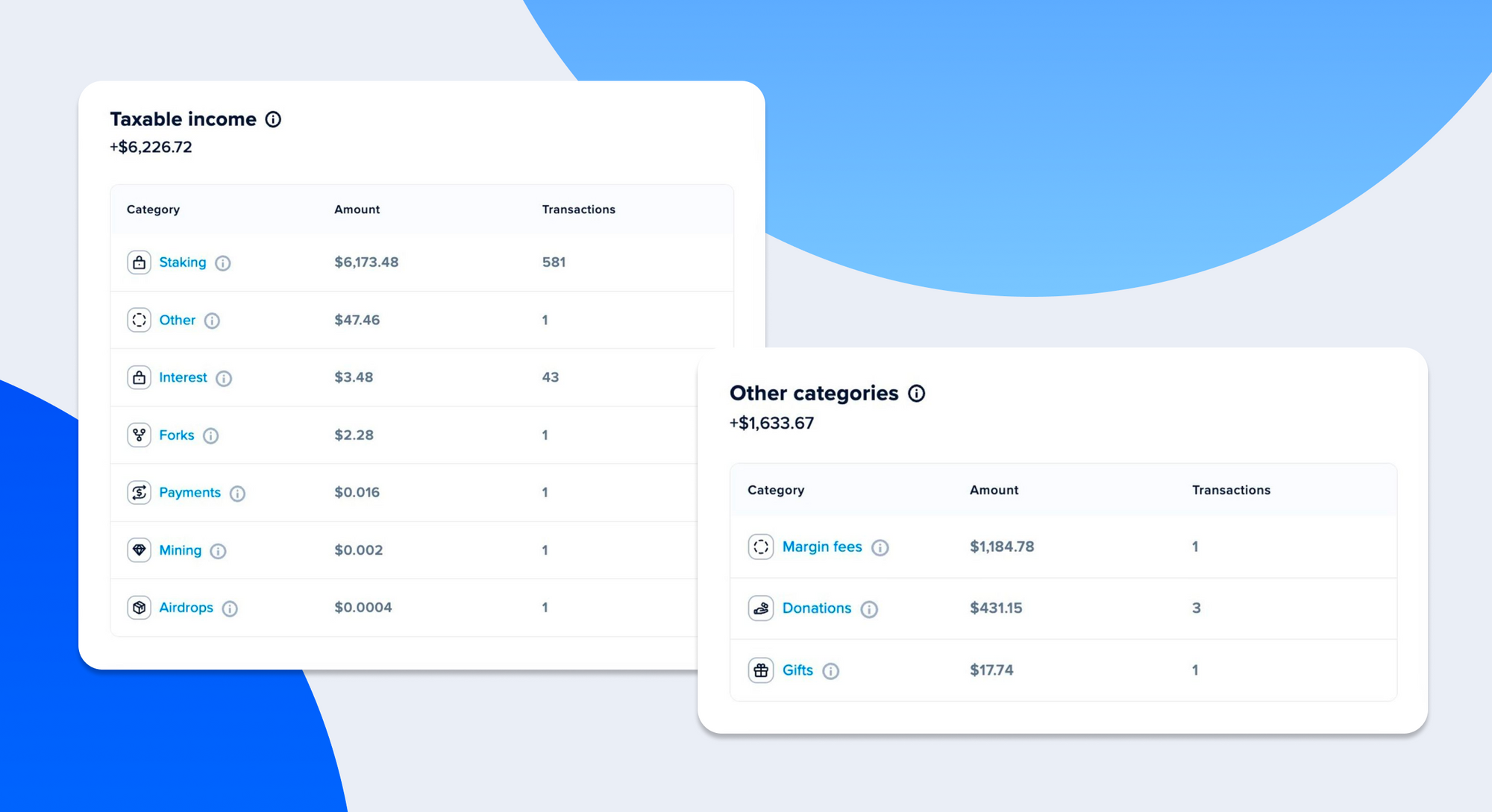

Revamped taxable income section

We have clarified the taxable income section on the tax center. You can now learn more about each category's meaning and how it impacts your taxes. We also added transaction counts so you have additional insight into your income.

🐛

Latest bug fixes

- Coinbase orders with canceled fills are now accurately synced

- Wrapping transactions are now detected across EVM chains

- Fees are correctly handled on the CoinJar Exchange

- Tax summaries always use a country’s tax year rather than the calendar year

- You can now manually edit mint transactions to other types